Empowering Widows' Wealth and Well Being

Navigate your new financial reality with a compassionate expert who understands. You don't have to face this journey alone.

70%

of women will be widowed

14-15

years average widowhood

Free 17-page SMART Goals Companion Guide • No obligation consultation available

AS FEATURED ON

Coach Kathleen Stapleton

CFP® | Fiduciary Financial Advisor

Feeling Overwhelmed? You're Not Alone.

When my mother became a widow, her experience revealed how unprepared many women are for this transition. Despite her education and resources, she faced overwhelming decisions during a time of profound grief.

Understanding "Widow Brain"

Grief affects cognitive function in measurable ways:

Difficulty concentrating and making decisions

Short-term memory challenges

Reduced ability to process complex information

This is why critical financial decisions should be delayed when possible.

Coach Kathleen Stapleton

CFP® | Fiduciary Financial Advisor

The Golden Rule of Widowhood

Make no major decisions for one year

Unless absolutely necessary, give yourself time to process grief before making life-altering choices about money, property, or relationships.

Guidance You Can Trust

CFP®

Gold Standard Certification

The CERTIFIED FINANCIAL PLANNER™ certification represents the highest standard in financial planning, requiring extensive education, experience, and ongoing ethics training.

Fiduciary Responsibility

As a fiduciary, I am legally and ethically bound to act in your best interest, always. Your financial well-being comes first, not sales quotas or commissions.

🔒

Confidential Consultations

All conversations are completely confidential with no obligation. Take the time you need to make informed decisions about your financial future.

A Clear Path Forward: The 3 Pillars Framework

Your financial plan should reflect your dreams, not only your fears.

"Grief is the price we pay for love."

— Queen Elizabeth II

Your journey through widowhood is deeply personal, but you don't have to navigate the financial aspects alone. Let's work together to protect your peace, well-being, and money during this major life transition.

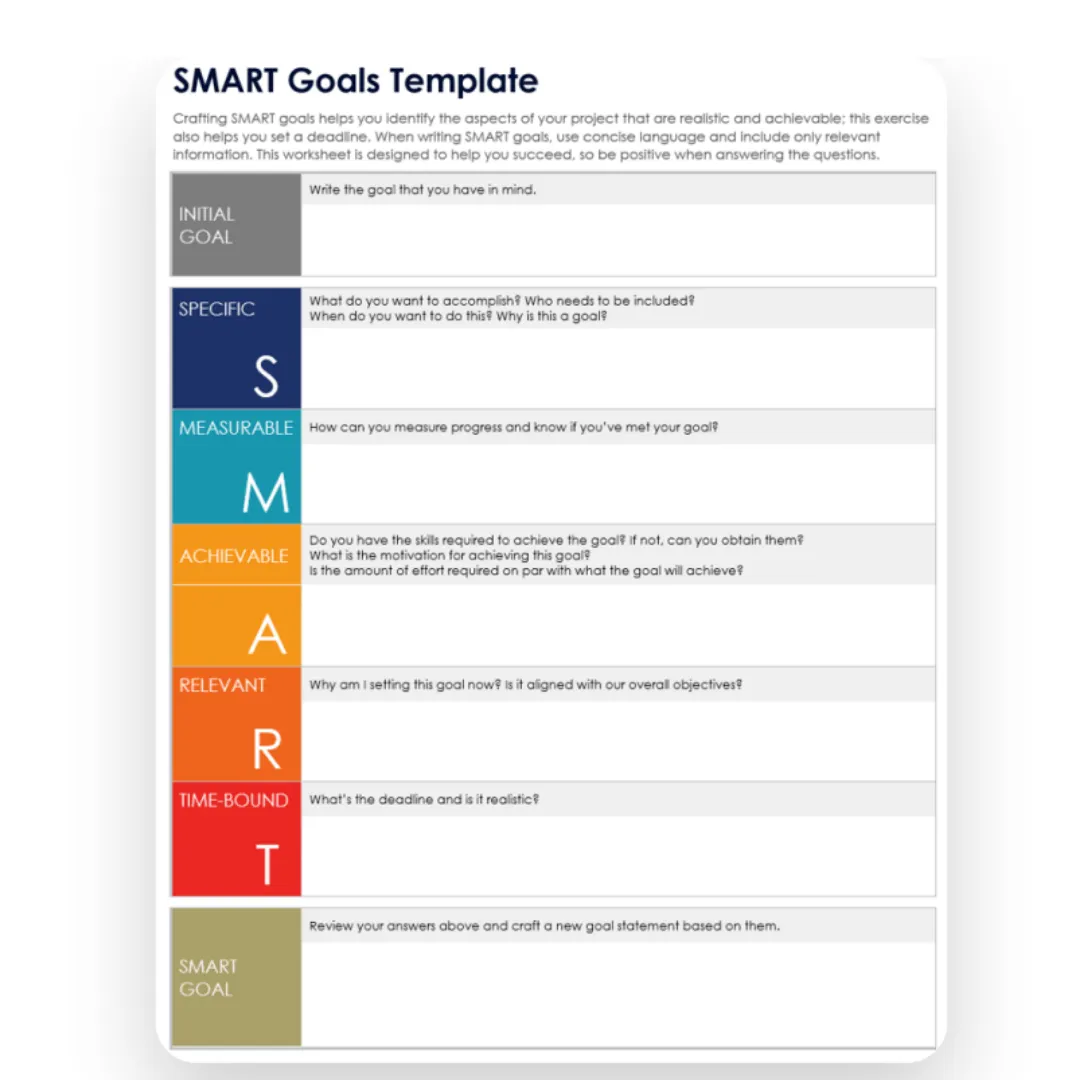

Claim Your FREE 17-Page SMART Goals Companion Guide

Navigate your financial journey with clarity and confidence — designed especially for widows and women facing life transitions.

Free 17-Page SMART Goals Companion Guide

This comprehensive guide will help you:

"I believe there are better days in your future!" - Coach Kathleen

Transforming financial overwhelm into confidence. Helping women, especially widows, educators, and retirees navigate their financial journey with compassion and expertise.

Kathleen Stapleton, CFP® practitionerEnhancing Women's Wealth & Wellbeing

© 2025 Kathleen Stapleton. All Rights Reserved.

CFP® and CERTIFIED FINANCIAL PLANNER™ are certification marks owned by the Certified Financial Planner Board of Standards, Inc. These marks are awarded to individuals who successfully complete the CFP Board's initial and ongoing certification requirements.